Introduction

In recent years, Artificial Intelligence (AI) has become the most talked-about buzzword across India’s IT corridors. From news headlines to conference rooms, the excitement is palpable: “AI will revolutionize everything!” But peel back the layers, and a more nuanced story emerges—one where real profits are concentrated with a handful of global giants, while India’s $245 billion IT sector primarily plays the role of facilitator, not innovator. In this post, let’s dig deep into the hype, the facts, and what it really means for India’s tech industry and its future.

The Hype: AI as India’s Next Big Growth Story

- AI market in India is projected to reach $8 billion by 2025, with a CAGR of around 40%.

- Every IT company, from TCS to Wipro, is advertising “AI-first” initiatives.

- Countless startups now add “AI-powered” to their pitch decks.

- Media stories regularly tout “AI jobs,” “AI unicorns,” and “India as the next global AI hub.”

But is the value and profit from AI really flowing into Indian companies? Or is the hype running far ahead of reality?

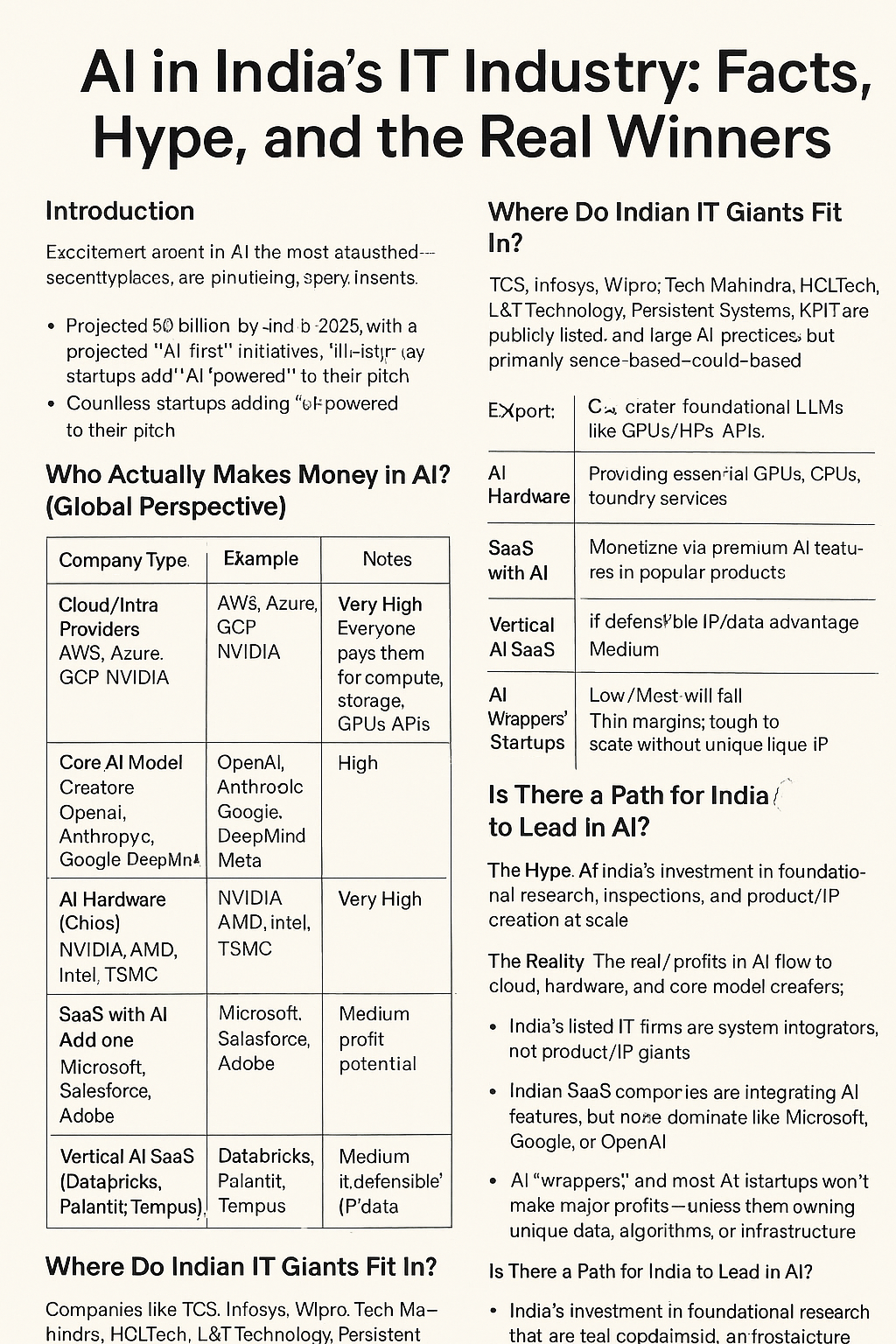

Who Actually Makes Money in AI? (Global Perspective)

Here’s a summary table of which types of companies globally capture real, large-scale profits from AI:

| Company Type | Example Companies | Profit Potential | Notes |

|---|---|---|---|

| Cloud/Infra Providers | AWS, Azure, GCP, NVIDIA | Very High | Everyone pays them for compute, storage, GPUs, APIs |

| Core AI Model Creators | OpenAI, Anthropic, Google DeepMind, Meta | High | License APIs, own foundational models, require big R&D |

| AI Hardware (Chips) | NVIDIA, AMD, Intel, TSMC | Very High | Provide essential GPUs, CPUs, foundry services |

| SaaS with AI Add-ons | Microsoft, Salesforce, Adobe | High | Monetize via premium AI features in popular products |

| Vertical AI SaaS | Databricks, Palantir, Tempus | Medium | Profitable if defensible IP/data advantage |

| AI “Wrappers”/Startups | Countless small firms | Low/Most will fail | Thin margins, tough to scale without unique IP |

Key Fact

Cloud, hardware, and foundational model providers make most of the money in AI—not system integrators or wrapper startups.

Where Do Indian IT Giants Fit In?

1. Service Companies, Not Product Owners

Companies like TCS, Infosys, Wipro, Tech Mahindra, HCLTech, L&T Technology, Persistent Systems, KPIT are all publicly listed and have large AI practices. But they are primarily service-based—they help global clients implement, customize, and operate AI solutions.

- They do not create foundational LLMs like OpenAI’s GPT or Google’s Gemini.

- They do not manufacture essential AI hardware (GPUs, chips).

- Their margins depend on billable hours and implementation—not on IP licensing or product sales.

What do they actually do?

- Integrate and deploy cloud-based AI solutions (from AWS, Azure, Google).

- Build AI-powered applications (chatbots, analytics, RPA) on top of existing platforms.

- Offer managed AI/ML operations, support, and consulting.

- Tweak and fine-tune off-the-shelf models for client needs.

What do they not do?

- Invent new foundational AI architectures or global-scale products.

- Build proprietary data platforms with massive network effects.

Are Any Indian AI Companies Truly Global Players?

Core Model Developers & Hardware

- None in India yet: No Indian company has created a globally recognized foundational model (like GPT-4, Claude, Gemini) or leads in AI hardware manufacturing.

- Early moves: Tata Electronics, Vedanta-Foxconn, and Reliance are planning semiconductor fabs; research labs like Sarvam AI, GigaML, KissanAI are building Indian-language LLMs—but the global impact is nascent.

Vertical AI SaaS/Startups

- Some promising vertical and sector-specific AI companies:

- Fractal Analytics (AI in analytics; still private)

- Haptik (Conversational AI, acquired by Reliance)

- Uniphore (Contact center AI)

- SigTuple (Healthcare diagnostics AI)

- Arya.ai, Lenskart, Swiggy, Zomato (AI/ML at scale for specific business problems)

None of these are publicly listed as of June 2025. Most are still venture funded, and very few are profitable at global SaaS scale.

What Kind of AI Work Will Service Companies Get?

If “everything moves to the cloud” and clients use Google/OpenAI/Microsoft for core AI, what do Indian IT companies actually do?

- Implementation: Hooking up client data and workflows to cloud AI APIs.

- Customization: Tuning models for local requirements, compliance, and regulations.

- Support and Operations: Managing, retraining, and monitoring models.

- Change Management: Training client teams, driving adoption.

But margins are lower and the work is more commoditized than “owning” the platform.

The Real Concern: Is the Indian IT Industry Over-Hyped on AI?

The Hype

- Indian media and industry presentations often create the impression that “India is the world’s next AI superpower.”

- Most big IT firms announce AI partnerships and initiatives in every quarterly result.

The Reality

- The real profits in AI—globally and in India—flow to cloud, hardware, and core model creators.

- India’s listed IT firms are system integrators, not product/IP giants.

- Indian SaaS companies are integrating AI features, but none dominate like Microsoft, Google, or OpenAI.

- AI “wrappers” and most AI startups will not make major profits unless they own unique data, algorithms, or infrastructure.

Is There a Path for India to Lead in AI?

- Possibly, yes—if India invests in foundational AI research, builds world-class data infrastructure, and supports product/IP creation at scale.

- Indian talent is already key to many global AI breakthroughs (often at Google, Microsoft, Meta, OpenAI… abroad).

- Government and private investment in chip manufacturing, local LLMs, and AI data ecosystems could create future leaders—but the results are 5–10 years out.

Conclusion

AI is the future—but only a small group of companies truly capture its massive value, and most of them aren’t Indian.

- India’s IT industry is brilliant at scaling, integrating, and supporting technology—but real “AI product/IP” leadership remains elusive.

- Most “AI” profits in India will, for now, go to service revenues—not to breakthrough inventions.

- The hype is real, the opportunity is massive—but so is the gap between today’s press releases and tomorrow’s true leaders.

If you’re investing or building in India’s AI ecosystem, focus on creating real IP, platforms, or unique data advantages—not just riding the next hype wave.

References and Further Reading

- Uttar Pradesh: India’s emerging silicon heartland for electronics and semiconductors

- India, a major user of coal power, is making large gains in clean energy adoption. Here is how

- Fractal Analytics

- Sarvam AI

- Haptik

- Uniphore

Want more data, a deep dive on Indian AI startups, or investment analysis? Drop a comment or connect!